Exits: 6/20/2025

How we did on the trades we exited this week.

Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None

Options

Call spread on Intuitive Machines (LUNR 0.49%↑). Entered at a net credit of $0.20 on 12/4/2024; expired worthless on 6/20/2025. Loss: 100%.

Puts on Sensata Technologies Holding (ST -0.21%↓). Bought for $1.10 on 4/17/2025; expired worthless on 6/20/2025. Loss: 100%.

Puts on RE/MAX Holdings (RMAX 5.53%↑). Bought for $0.75 on 4/17/2025; expired worthless on 6/20/2025. Loss: 100%.

Put spread on Mercury General ( MCY 1.99%↑). Entered at a net debit of $1.35 on 1/14/2025; expired worthless on 6/20/2025. Loss: 100%.

Puts on Mercury General ( MCY 1.99%↑). Bought for $1.60 on 1/14/2025; expired worthless on 6/20/2025. Loss: 100%.

Call spread on Nutrien (NTR 0.44%↑). Entered at a net credit of $3.05 on 5/6/2025; exited at a net debit of $4.88 on 6/18/2025. Loss: 94%.

Call spread on West Fraser Timber (WFG -1.01%↓). Entered at a net credit of $3.25 on 5/7/2025; exited at a net debit of $3.20 on 6/20/2025. Profit: 2.9%.

Calls on MP Materials (MP 5.70%↑). Bought for $1.05 on 6/13/2025; sold for $3.70 on 6/18/2025. Profit: 252%.

Call spread on Tesla (TSLA -0.26%↓). Entered at a net debit of $1.15 on 3/13/2025; exited (second part) at a net credit of $4.74 on 6/16/2025. Profit: 312%.

Comments

Stocks or Exchange Traded Products

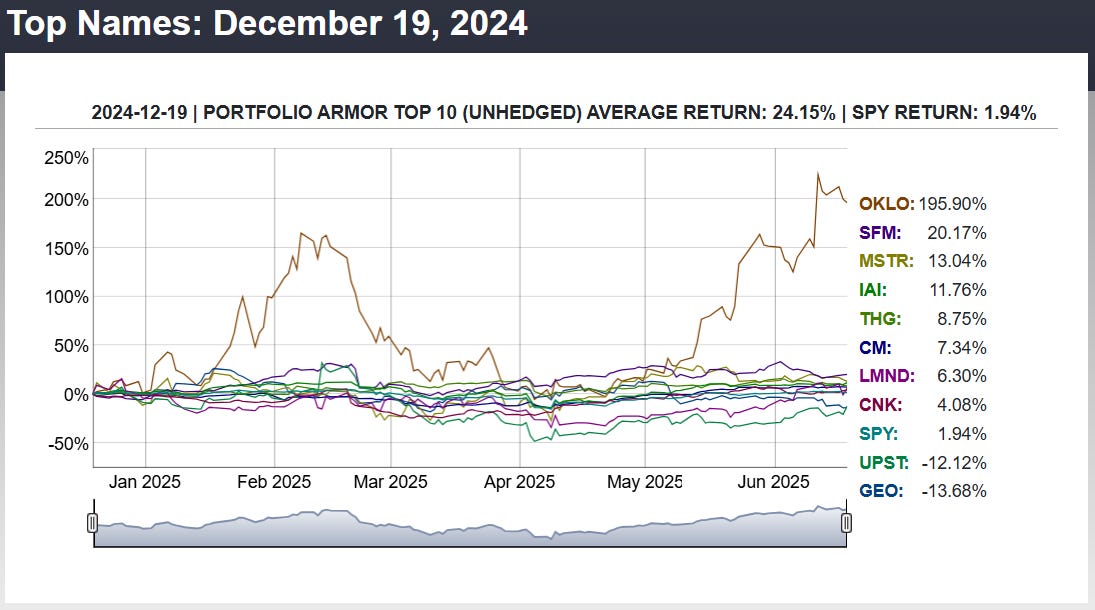

No exits this week, as I haven’t gotten back into our core strategy yet (probably will next week), but since I started this Substack in December of 2022, our top names have averaged returns of 16.7% over the next six months, versus SPY’s average of 9.47%.

Here’s how our most recent top names cohort to finish its six month run did:

Options

This was the big options expiration date for the month, and that’s where our losing trades tend to collect (because we usually exit our winners before expiration). Today, we have losing trades appearing that were opened as long ago as last December. With the exception of Intuitive Machines (LUNR 0.49%↑), our losing trades were all bearish ones:

Mercury General ( MCY 1.99%↑): A bearish bet against the leading property insurer in Southern California after the fires last winter. That insurer was I guess better positioned than I expected. It probably helped that most of the value of the destroyed properties was in the land itself, rather than the structures.

Sensata Technologies Holding (ST -0.21%↓) and RE/MAX Holdings (RMAX 5.53%↑): bearish bets from an AI-designed Chartmill screen.

Nutrien (NTR 0.44%↑) (and West Fraser Timber, which we exited with a slight gain): bearish bets against Canadian stocks that seemed likely to be hurt by Trump’s tariffs. Maybe they weren’t, or maybe we should have used further-out expirations.

In the case of Intuitive Machines, that stock never recovered after one of its moon rovers crash landed on the moon.

If You Are Concerned About Market Risk

If you’re worried the Israel-Iran business might spiral out of control, as a reminder, you can use the Portfolio Armor iPhone app (or website) to find the optimal hedges, given your time frame and risk tolerance, to protect your investments.