Exits, 4/25/2025

How we did on the trades we exited this week.

Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None

Options

Puts on Apple (AAPL 1.18%↑). Bought for $1.81 on 4//14/2025; sold for $2.71 on 4/21/2025. Profit: 50%.

Put spread on Celestica (CLS 0.61%↑). Entered at a net credit of $3.12 on 3/27/2025; exited at a net debit of $2 on 4/25/2025. Profit: 59.6%.

Puts on Nvidia (NVDA -2.83%↓). Bought for $1.56 on 4/9/2025; sold for $4.02 on 4/21/2025. Profit: 158%.

Comments

Stocks or Exchange Traded Products

No exits this week, but since we started this Substack in December of 2022, our top names have averaged returns of 17.4% over the next six months, versus SPY’s average of 11.06%.

Options

Three out of three profitable exits this week. One move that turned to be good in hindsight was taking a 50% gain on our Apple puts on Monday, rather than holding out until later in the week for a bigger gain. I think I may add that as a trading rule: if we’ve got a profit on long put or call position on Monday, and that option expires that week, just take the profit then.

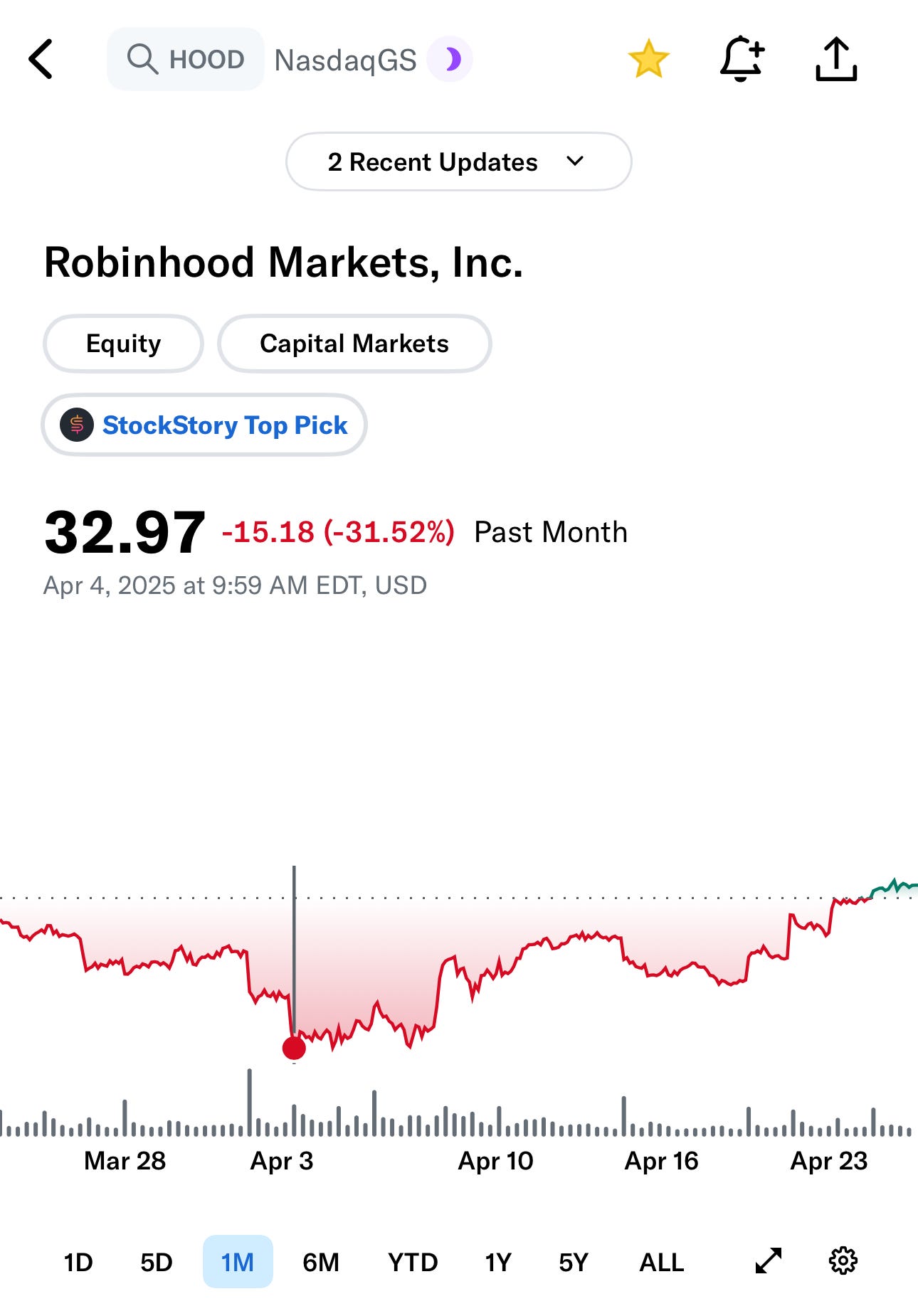

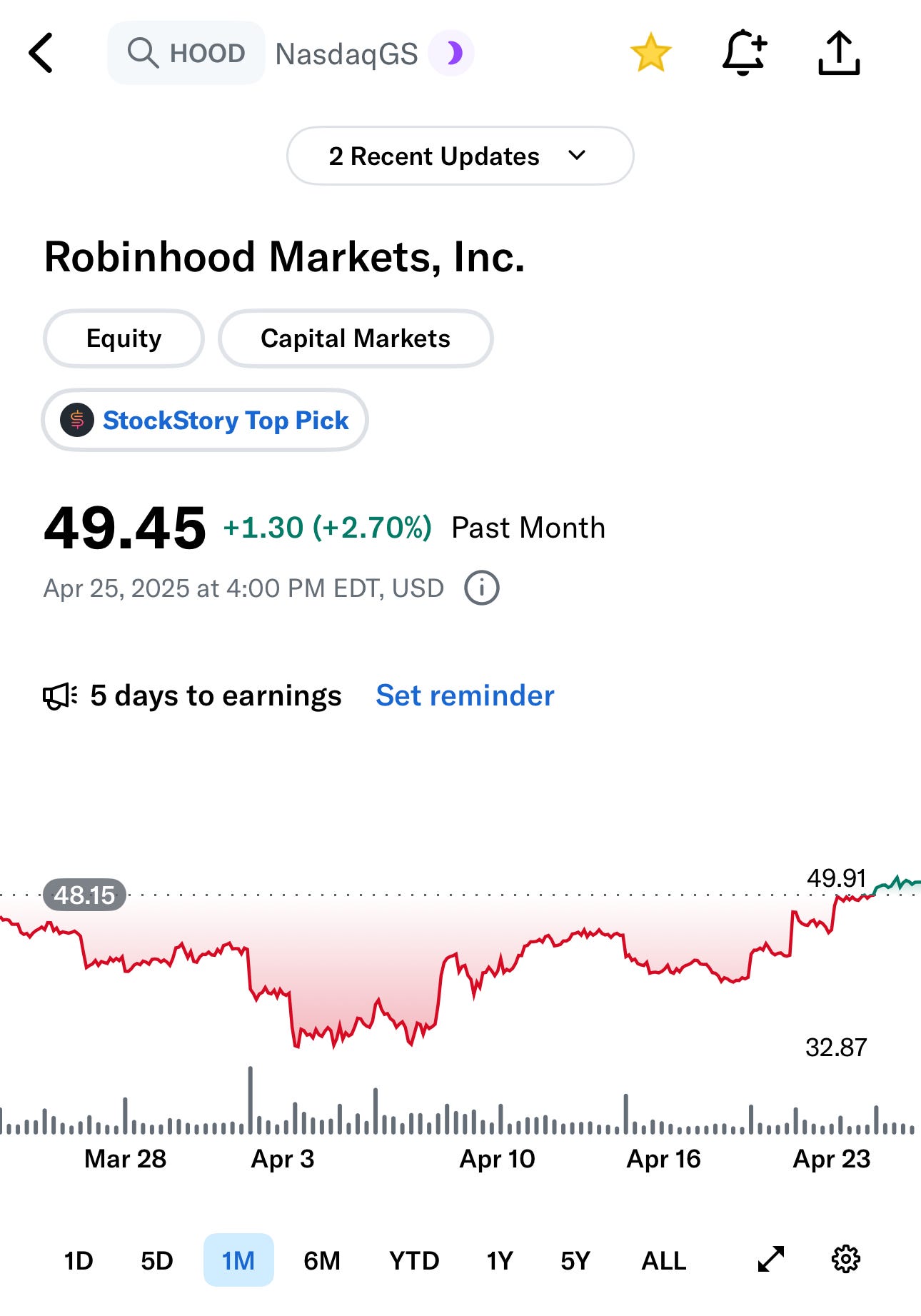

Another rule I think I am going to add is if we sell cash-secured puts on a stock, we buy OTM calls at the same time. We sold puts on Robinhood Markets (HOOD 0.47%↑) when the stock bottomed on April 4th, and it’s up about 50% since then.

We would have made a lot of money buying OTM calls on it then. Next time (which may not be too far away, in this market) we will.

Adding Downside Protection

If Monday ends up being another up day, consider taking the opportunity to hedge. If you're not sure exactly what to do, you can simply divide the dollar amount of your portfolio by the current price of SPY 0.00%↑, round it up to the nearest hundred, and then enter that in the Portfolio Armor iPhone app along with your risk tolerance, to find the optimal put options to give you the protection you need at the lowest possible cost.

As a reminder, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.