A Game Plan For The Israel-Iran War

What's likely to happen next, and how we can trade it..

This Time It's Different

Iran's retaliation ballistic missile strike against Israel late Friday indicated that this conflict was different from anything last year. Unlike Israel's decapitation strikes on Hezbollah, Iran was still standing after eating Israel's first strike. And unlike previous exchanges between Israel and Iran last year, both sides were firing for effect, with bad intentions. By Friday's market close it was clear that this was a real war.

Energy and volatility markets responded fast:

Brent crude settled +7 % Friday at $74.23 — its biggest one-day jump since the Russia-Ukraine invasion’s opening week.

The VIX closed at 20.8 (+15 %). “Elevated,” not “panic” (panic is >35).

Friday’s hedge — a quick post-mortem

On Thursday I opened a VIX call-spread hedge. I peeled it off in two tranches on Friday for gains of +159 % and +53 %, respectively, before Iran's first ballistic missile strikes landed in Israel. In hindsight I probably should have kept that second slice open, but hindsight is cheap tuition.

What Happens Next

Questions remain about what Israel's endgame is here. Some have suggested the goal is to spark regime change in Iran, but that seems unlikely to happen. If anything, Iranians are likely to rally behind their current government in the face of Israeli air strikes.

Others say Israel's goal is to destroy Iran's nuclear program, but It's unclear whether they are capable of destroying Iran's heavily fortified and deeply buried Fordow Fuel Enrichment Plant on their own. Israel has 5,000lbs bunker-buster bombs, but some analysts speculate this site might require the 30,000lbs GBU-57/B bunker-busters, and Israel doesn't have any bombers that can carry that. The only bomber we know can carry it is the B-2 Spirit stealth bomber, and no country other than the U.S. has that plane.

Some Israel supporters, such as hedge fund manager Bill Ackman, have called for the U.S. to bomb that plant.

But President Trump has said the U.S. will only strike Iran if Iran attacks U.S. assets first, and has suggested diplomacy as a way to end the war. Of course, one risk of the U.S. getting involved in this war is that Russia or China might decide to supply Iran with arms and intelligence against us, the way we have with Ukraine against Russia. If Russia gave hypersonic Zircon anti-ship missiles to Iran, they could potentially sink a U.S. aircraft carrier.

Let's consider some plausible paths forward and how likely each might be.

What’s not priced-in yet

Crude is still below January’s highs.

VIX is only at “heightened,” not “panic,” levels.

Airlines slumped but didn’t puke.

Translation: the market is still pricing a scare, not a catastrophe. We'll see if that changes when futures open tonight.

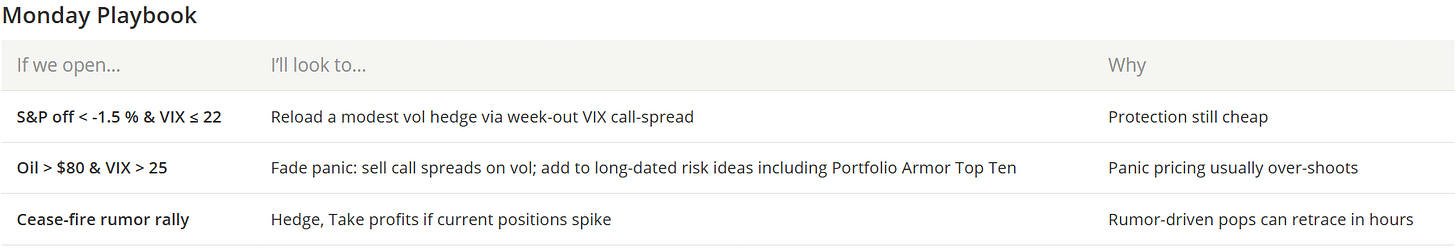

Final thought: Focus On Price

Wars are foggy, but the tape is clear. Futures reopen at 6pm ET; by Monday’s cash open we’ll know whether the market still calls this a scare, or something bigger.

Stay nimble, keep an eye on crude and vol, and remember: you don’t need to buy every dip or short every rip. You just need to catch the fat part of the move and manage the tail risk. For managing tail risk, you can use the Portfolio Armor iPhone app (or website, if you don't have an iPhone).

A Set-It And Forget-It Approach

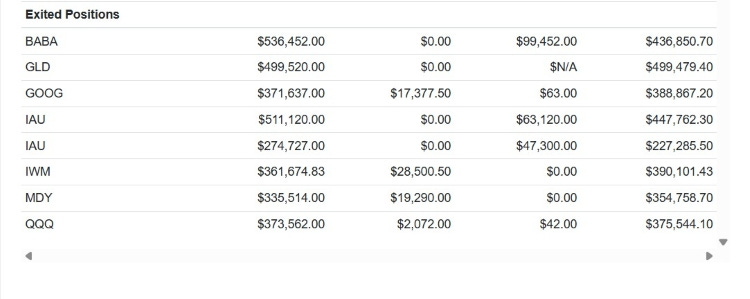

I don't talk about this a lot because it bores me, to be honest, but for a lot of investors, boring is good. With the Portfolio Armor website's hedged portfolios, you just tell the system how much you want to invest, and the largest decline you are willing to risk over the next six months, and it does the rest.

It constructs a concentrated portfolio of a handful of securities and hedges designed to do exactly what you ask. Here is a hedged portfolio that finished its 6-month runs last week, a time period that obviously included April's market crash.

Hedged Against A >4% Decline

You can find an interactive chart of that portfolio here.